Decommissioning Prisma Finance - A Turbulent but Ultimately Soft-Landing

As the Resupply team prepares for an exciting launch, one pesky task has occupied the focus of the team: shutting down Prisma Finance, a hacked Liquity fork that has since become a ghost ship. Once supported by Yearn and Convex liquid locker products, Prisma Finance was abandoned by its team, leaving it in a fragile state. Resupply was in fact originally conceived as a replacement for Prisma, which governance approved with PIP-46. But unwinding the system turned out to be a trickier task than expected.

In this post I’ll highlight how we:

- Discovered and worked around a critical bug found in Trove Manager accounting, allowing users to regain access to their collateral and avoided introducing bad debt into the system.

- Discovered a bug in the ULTRA stability pool that allowed an attacker to extract approximately 13.92 ETH that did not belong to them.

- Created a creative solution to combat upward depegs by allowing users to close their loans using a separate stablecoin.

Exposing a Trove Manager Accounting Bug

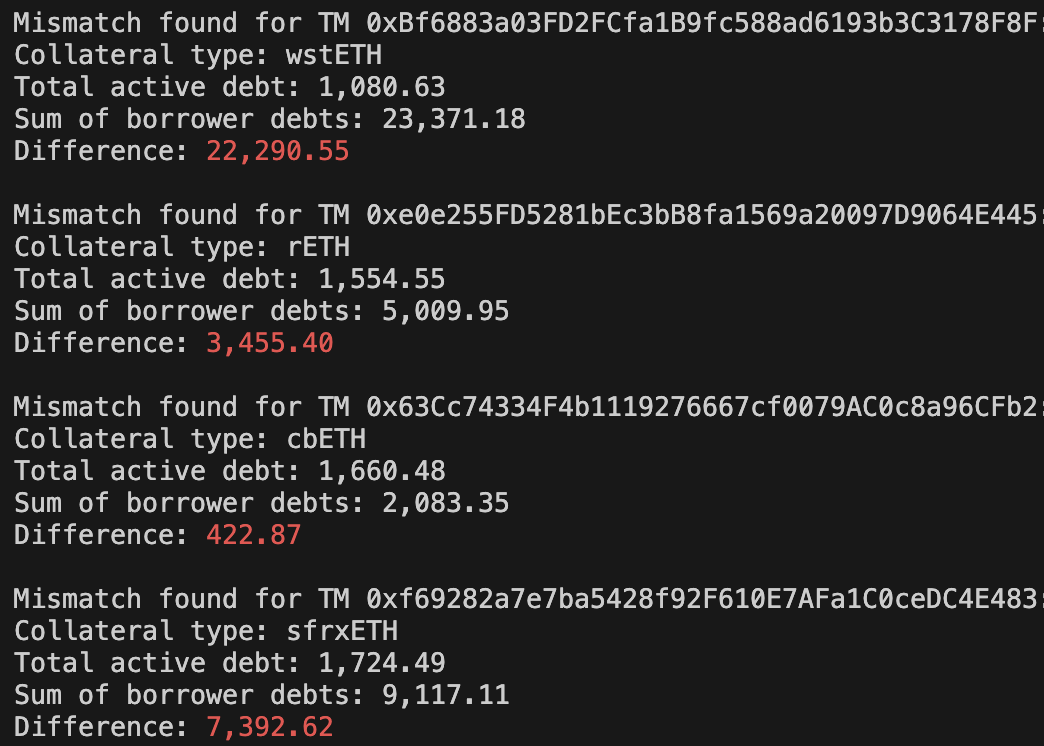

As Prisma’s TVL dwindled (thanks to the PSMs which I will describe in a later section), a subtle accounting issue was brought to light. I noticed a sizeable mismatch between the sum of user debt and what the trove thinks its total debt is.

Sum of borrows exceeds total active debt.

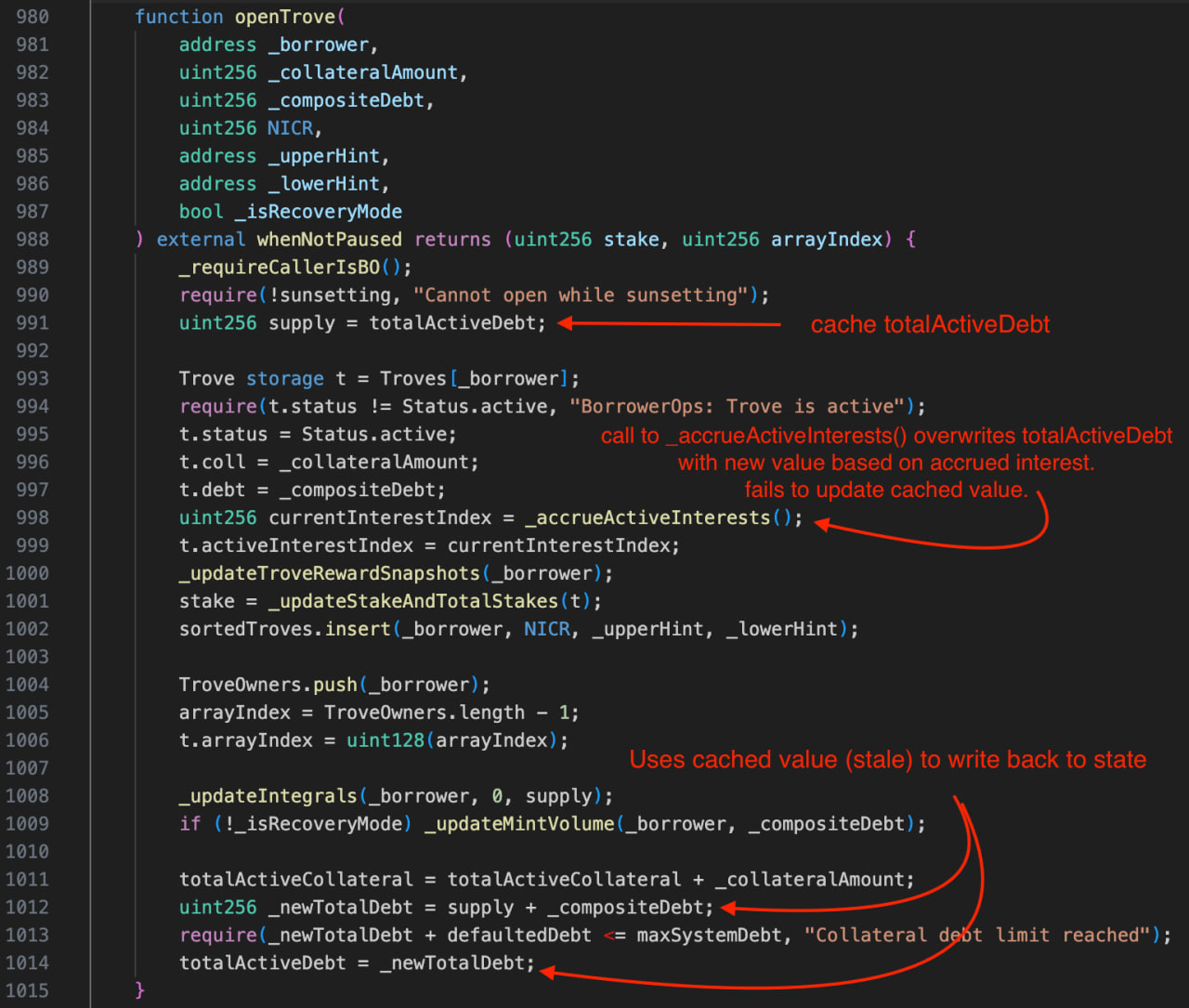

Clearly there is some sort of accounting bug at play here, and the search for the culprit was on. After meticulous code inspection and help from Tenderly, I was able to trace the issue to the openTrove() function.

The bug in the Trove Manager's `openTrove()` function.

The bug in the Trove Manager's `openTrove()` function.

As you can see, the code incorrectly writes a state update to totalActiveDebt using a stale value that doesn’t include the interest accrued since the prior checkpoint. During normal operations, this bug was largely transparent because totalActiveDebt was high enough that there was no underflow risk when subtracting a repayment amount. But if the discrepancy is big enough, and as TVL drops, even a modest sized repayments can trigger it. In fact, the bug would render repayments, redemptions, and even liquidations impossible because when the final borrower repays, say $1,000 the trove manager’s attempt to subtract that amount from totalActiveDebt (some number less than $1,000) will underflow. These reverting transactions effectively trap users’ collateral.

Come to find out later, a patch was introduced by Prisma in one of the later versions of their Trove Manager code. So this bug is only present in older versions of trove managers.

Unfortunately, there is no way to manipulate this value back in line with where it should be. Additionally, at this point, governance had already placed all Trove Managers in “sunsetting” mode, preventing any obvious methods of intervention. However, we discovered a loophole: the ability for governance to upgrade the oracle was still available.

By setting a custom oracle that priced collateral at type(uint).max (effectively infinite), users could withdraw their collateral, minus a small dust amount. Essentially, given the manipulated price, users need just a few wei of collateral would be used to collateralize the outstanding debt. This maneuver created about $35,000 in bad debt as stuck users were relieved of their remaining debt.

In a nice piece of news, we found more than enough money to pay that down via unclaimed crvUSD earned by Prisma’s veCRV voter. Transferring this crvUSD to the PSM now means that all mkUSD is backed 1:1, and the protocol is fully solvency.

Identifying the Stability Pool Exploit

In late December, a Discord user pastelfork flagged a new issue during the shutdown: collateral gains from the ULTRA stability pool depositors couldn’t be claimed. After some review, we discovered a bug introduced to ULTRA’s stability pool. An errant line in claimCollateralGains() resets a value that should have been zeroed out, incorrectly allowing repeated claims of the same amount until the pool is fully drained.

…

A user was able to extract approximately 13.92 ETH that did not belong to him. In all likelihood, he didn’t set out to find this bug, but rather stumbled across it.

Looking at Etherscan, you can see just a sample of the many repeated claims he made to drain the pool.

To prevent further abuse, a call to users to withdraw from the ULTRA stability pool was issued.

Stablecoin Hoarders Trigger an Upward Depeg

Shutting down Prisma began with reducing the debt ceiling to zero, preventing new mkUSD and ULTRA loans. However, this move triggered a destructive market dynamic: mkUSD and ULTRA, Prisma’s stablecoins, deviated from their $1 peg, climbing as high as $1.45. This happened because these stablecoins are required for borrowers to close their loans. Opportunistic traders saw this as a chance to hoard these tokens, driving up the prices, allowing an eventual sale at a profit.

Our solution was announced in PIP-47: Operation Rainbow Pegger which introduced the concept of a custom Peg Stability Module (PSM) disguised as a regular Trove Manager, giving it permissions to mint new stablecoins. By design, the PSMs offer two-way purchasing of stables via key functions:

-

repayDebt: Accepts crvUSD, mints corresponding amount of mkUSD/ULTRA at a 1:1 rate, and closes the user’s loan atomically. -

sellDebtToken: Burns mkUSD/ULTRA and returns crvUSD at a 1:1 rate.

This innovation got the protocol out of the jam by providing users with liquidity they needed, and eliminated the price gouging. The PSMs will exist perpetually to facilitate repayments and serve as a facility to redeem mkUSD and ULTRA.

Custom UI development work was done to provide users with an app to interact with the PSM.

As of writing the PSM balances are as follows:

Wrapping Up

Shutting down Prisma is still in progress, with less than $80k debt remaining, but it was far from straightforward. Between economic exploits and protocol bugs, the process required custom tools, clever engineering, and delicate maneuvering to ensure users exited with minimal harm. The experience highlights the complexity of unwinding DeFi protocols and the importance of testing.